VAT treatment & EV charging

- Based on article 15 of the EU VAT Directive 2006/112/EC the supply of electricity is considered a supply of goods without there being any cross-border transport of these goods (article 17 sub 2d of the EU VAT Directive)

- The supply of electricity to an EV driver or so called “end user” (which can be a private or a business customer) is taxable in the country where the charging session has taken place (article 39 of the EU VAT Directive)

- The supply of electricity to anyone that is not consuming the energy but reselling it, is taxed where the reseller has its legal entity, permanent establishment or usual place of stay (article 38 sub 1 EU VAT Directive).

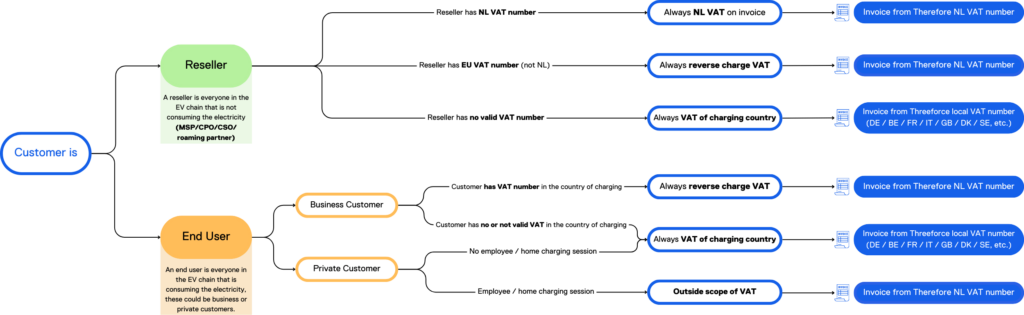

VAT treatment Customer (reseller) <-> Last Mile Solutions -> EV Driver

- Within the EV charging supply chain, Last Mile Solutions is part of the supply chain and is therefore supplying goods. The EU court ruling (Case C-282/22 based on the Directive 2006/112/EC) specifically adds the technical/digital platform as a supplier in the EV charging chain and not as a separate service supplier or a billing agency. The second question then is: where in the EV chain should Last Mile Solutions be paced? The EU VAT committee has published guidelines (118thmeeting of 19-04-2021: Document C – taxud.c.1(2021)6657618-1018) that basically state that all EU member states unanimously agree that it is the MSP that supplies the EV driver (and not the CPO or energy supplier).

- Looking at our SaaS agreement, Last Mile Solutions takes over almost all the MSP’s activities: we offer the platform in which the EV driver can register with the MSP, we open the station when it recognizes the charge card, we track the session, we publish the rates, we provide technical support and at the end we invoice the driver. To do that, the end user signs an end user agreement with the MSP in which he agrees to transfer this part of the charging session to Last Mile Solutions. This gives Last Mile Solutions the legal title to send the invoices and, more important, act if they remain unpaid since Last Mile Solutions takes over this risk from the MSP as well. It also takes over the MSP’s obligation to register for VAT and pay VAT in all countries where EV drivers charge the car, so our business model is not that of just a billing agency, it is more complex, and we are a vital part of the EV supply chain.

As Last Mile Solutions and MSP are both resellers in this chain, this means Last Mile Solutions will invoice MSP and/or MSP will invoice Last Mile Solutions (via self billing process) based on these articles, with reverse charged VAT since the place of supply is the Netherlands. This is a mandatory reverse charge rule. You can find these rules in article 195 of the EU VAT Directive (2006/112/EC).

If Last Mile Solutions invoices MSP’s end users (B2B/B2C), VAT of the country where the charging session has taken place will be invoiced, reported and paid by Last Mile Solutions under the VAT registration number we have in these countries. For B2B customers who have a valid VAT ID in the country where the charging session has taken place, VAT will be reverse charged as well. (Article 195 of the EU VAT Directive refers to both resellers and end users).

VAT Flows

| Transactions within Europe | |

| Non-Dutch Reseller | Invoice with VAT reverse charge from Threeforce BV (NL) |

| Non-Dutch Reseller with invalid VAT ID | Invoice with VAT charging country from Threeforce BV (local) |

| Dutch Reseller & Non-Dutch Reseller with a valid NL VAT ID | Invoice with NL VAT from Threeforce BV (NL) |

| B2B customer with a valid VAT ID in charging country not NL | Invoice with VAT reverse charge from Threeforce BV (NL) |

| B2B customer with a valid VAT ID in charging country NL | invoice with NL VAT from Threeforce BV (NL) |

| B2B customer with no/invalid VAT ID in charging country | Invoice with VAT charging country from Threeforce BV (local) |

| B2C customer no home charging | Invoice with VAT charging country from Threeforce BV (local) |

| B2C customer home charging | Invoice without VAT |

| Transactions outside Europe | Invoice without VAT |